Dearest friends,

I suppose at one point, I would discuss personal finance. So here it is. The finance of persons, or a bit of it, as I understand it. Call me Mr. Monsieur Moustache. Let’s go down to New York, The New York, and follow the money.

The following is not a definitive theory, but merely my hypothesis. I don’t know *for sure* what has caused this to happen, but here is what I think.

Repeat after me: Volatility is not risk. Volatility is not risk. Volatility is not risk.

Imagine two agents. The first entity, call it the rentier, is concerned with extracting value sufficient to live a comfortable life off of their assets. The goal of a rentier is not the maximization of their own wealth, but their own survival through long time, preferably in maximal comfort. Therefore, the rentier wants to invest in something where the returns exceed the erosion of purchasing power (inflation) plus their own desired safe rate of withdrawal (a number I typically ballpark, arbitrarily, at 2% for long time) plus an amount to be reinvested to maintain a margin of safety against uncertainty, such that the fund is never overdrawn during bad times.

So the equation faced by the rentier is as follows.

ROI > I + MS + RS

Where the terms stand for inflation, margin of safety, and safe withdrawal rate.

Now, the naive supposition is that these people will chase as much yield as they can. That’s a misunderstanding of rentier psychology. If that were the case, you would see the fortunes of old money balloon into infinity. Simultaneously, if the fate of old money was to lose money, you would not see old money at all – the term would be meaningless and the concept nonsense. Some people do deny the existence of old money and confidently proclaim the saying, “Shirtsleeves to shirtsleeves in three generations.” To that, I say that if you take that as the null hypothesis (persistence = .4), the odds of my family surviving to the present are like the odds of picking a single grain of sand correctly out of all the grains of sand on Earth. And some of our rivals from those very old days are still around. You see this around the world, from the Norman conquerors, to Florentine elites, to American colonial fortunes. The probability of a family surviving like that by chance is well past 1e-9*.

Why wouldn’t an aristocratic family want to maximize yields? All too often, power means problems. The majority of people are content to live a life of comfort and ease. The goal of a Cloud Person family is not to slowly expand until it engulfs the whole world, and despite the maxim of r>g, this does not and cannot hold in the micro scale. No tree grows to the sky. r>g implying the growth of elite fortunes only holds in the macro/societal sense, implying the steady expansion of the noble/professional class through an empire’s lifespan, what Turchin calls elite overproduction. An individual aristocratic family stagnates, stuck in a perpetual decline towards poverty but never quite getting there, a dramatic WASP (although, strictly speaking, I believe the term Norman-American is more historically accurate) heiress lamenting the fall of her house with a breathy “Alas!” (To my beloved sad one, do not hit me.) This is a holding pattern which can safely last centuries or millennia.

How does one successfully stagnate? The avoidance of risk. As they say in finance, rule 1 is to not lose money. That doesn’t mean never take losses, it means never blowup. Risk is not volatility, but the chance of an investment blowing up. And fatal risk, the kind you never take, is when these blowups blow you up, not just your investment. But even lesser blowups hurt bigly. Rather than pursuing maximal returns, a prudent aristocrat acts contra the prescriptions of economists and their rational Homo Economicus, but instead minimizes their exposure to blowup SO LONG AS THEY ARE ABLE TO SATISFY THE RENTIER EQUATION WITH THE BASKET OF ASSETS.

What’s the other half of this capital equation? Why, people who want to take that money and make more money, like yours truly. Call them the capitalists. Value can beget value, wealth can birth wealth. Little golden soldiers march out and produce a building, a factory, a monument to prosperity. A would-be capitalist presents an opportunity, like open a restaurant on Fifth Street, speculate on macroeconomic conditions, buy oil futures, make loans to greased up deaf guys, and gets capital. Money is not free. Money is not free! Money has a price. What is this price? Interest. Interest is the cost of acquiring money. For the capitalist, interest is a cost. So far, this all hews to conventional theory. But conventional theory holds that lower interest spur further investment, because the lower cost of money increases the profitability of investment until it attracts a taker.

But is this the case? Let’s imagine an extreme example (which is increasingly less extreme in this day and age). If you can borrow at 0%, you can grow this money and have a safe rate of return by putting it in a brokerage and enjoying 2% interest. If you are a rentier, you are now satisfied. If you are a capitalist playing this skim somehow, you are satisfied. Economic activity is not really happening. Business is not growing. Money is stuck in a brokerage, doing activities where the broker can’t lose too much money and collapse from a bank run. The money sits under a mattress, useless. If you can borrow at a sufficiently negative rate of interest, then you don’t have to do anything. You can sit on a dragon’s hoard of gold and wait for your purchasing power to steadily increase.

What generates new wealth? Entrepreneurship. Innovation. Expansion. These are activities which yield very high returns. In some sense, you can say that you’re rewarded handsomely for this. But this is foolish. You are actually exposed to a lot of real risk, even if the asset is not volatile. It can explode! Rentiers are not in the business of investing in entrepreneurs and business, even if this is a fundamentally profitable thing to do. Rentiers want to stay safe. Their interests lie not in profit maximization, but an indefinite stay at the top. Accordingly, you have to force them into riskier asset classes. The lower the interest rates, the lower you can descend on the risk chain while still surviving as a rentier. At very high interest rates, you might only be able to maintain rentier status by investing in direct business ventures while maintaining a store of gold as your margin of safety. As interest rates decline, stocks and corporate bonds become attractive vehicles. Fall further, and you can just dick around on an infinitely leveraged bank deposit. The items higher on the risk totem are closer to the production of real value. First you build a business, then you invest in developed businesses so they can grow, then you lend to a government or a bank which might invest in developed business so they can grow, etc. Just as delta can be said to be an option’s moneyness, yield is an asset’s entrepreneuriness. The closer you get to the fray and the struggle of business competition, the sweeter the returns. Rentiers aren’t charities. They’re families that delay consumption for millennia so they can sit and drink pina coladas. They’ll only do what they’re obliged to do so, whether from financial need or cultural bonds.

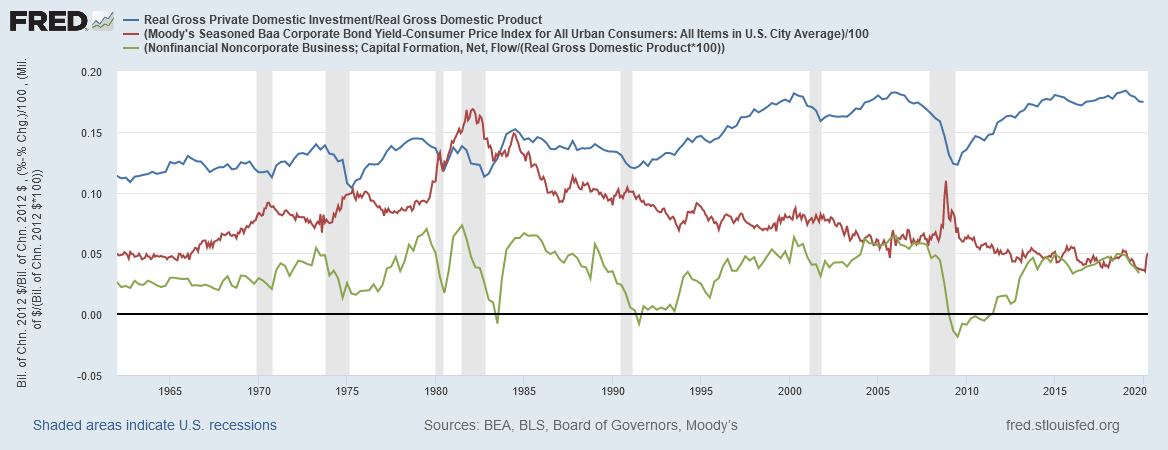

Here’s a chart.

The red line is real interest rates.

The blue line is investment as a proportion of real GDP.

Viewed this way, investment goes up when interest rates go down. The monetarist thesis is confirmed. The long run secular decline in interest rates is a steady increase in investment spending over time. And that’s why every Tom, Dick, and Harry can start a business.

Except… the green line.

What is that green line?

The green line is net investment in new business. If you tell the story of the green line, then business investment (as opposed to purchasing blue chips and AAA bonds) is anemic, barely responding to interest rates as monetarists would expect. Actually, it does the inverse. New business investment never does better than during the terrible super interest rates of the early 1980s. As interest rates decline, the spread between investment spending in general and business investment shoots up and never looks back. We call that asset inflation. The low interest rates allow for more leverage, and thus more capital directed at assets, but business activity becomes disfavored. You can see that investment overall goes up, but business investment is anemic! Particularly, you can note 2 years of net negative business activity under Obama, the first time a contraction has ever exceeded a quarter in length.

Why would people feel the Obama recovery was fake? Why were the roaring 80s so roaring? What does GDP mean for lived prosperity? I believe the net business formation better reflects the perceived health of the economy, because small business is more linked to the prosperity of the average American. While big business generates the GDP and pays out handsome salaries and benefits, the majority of new jobs come from small business. Up until very recently, a majority of people still worked for small businesses. The expansion of big business into mass employment with McJobs is not precisely a trend to root for either. Small business keeps America employed, and employed America stays away from drugs, despair, and depression.

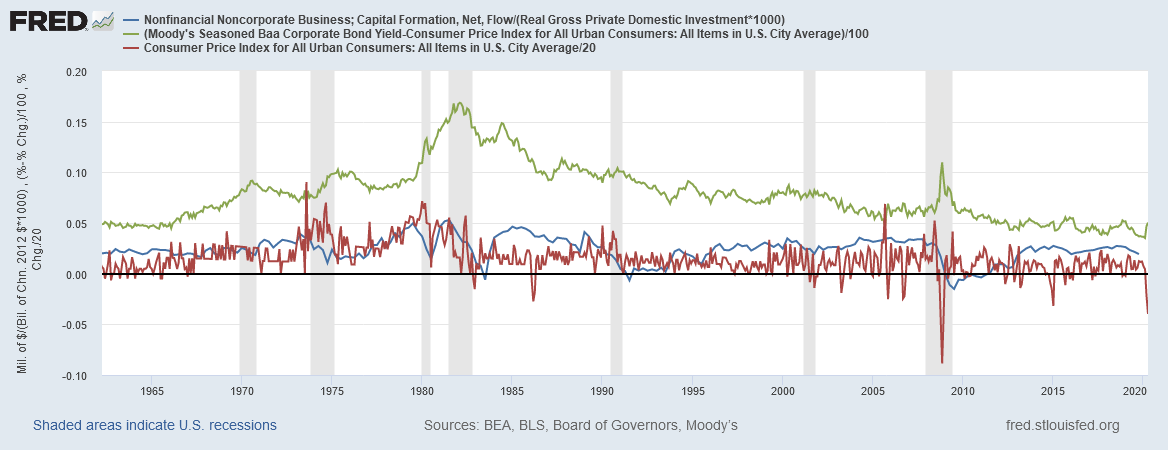

Here is a chart with business formation, inflation, and interest. We can see neither curve is a perfect fit, but again, contrary to establishment thinking, there is a clear positive correlation between inflation and business. Accordingly, the Fed’s goal is to keep inflation… low. At least this, I consider more forgivable because inflation serves as a tax on the middle class, which primarily holds hard cash instead of investments.

We can consider this a variation on the Austrian economics theme of malinvestment. Essentially, the lower the interest, the more investment classes become viable as a means for a rentier to maintain their wealth. That means money is driven from business into these other categories, causing a buildup of assets that would not happen under the free money market of gold or some other deregulated currency. Interest being the cost of money, the demand for lots of money to play games with bonds instead of increasing direct production would drive the price of money up. The difference is that the activity is rentier-based, not entrepreneur/capitalist based. The Austrians suppose that entrepreneurs start businesses because of low interest rates, or that a fund might start a strategy because of favorable rates. Not so. Entrepreneurs start new businesses because they are entrepreneurs and they have a screw loose. Similarly, funds don’t wind up when the interest rates go against them. It’s the way rentiers allocate their capital that changes, in accordance with the least risk principle. Some people blame the complacency of the American people for the decline of business. But if this was the case, then the amount of capital per business would rise, as all the investors converge to invest in the few remaining gritty entrepreneurs. Many of the people who espouse this theory believe that immigrants are needed to inject a entrepreneurial spirit into America. Put bluntly, this is bullshit and a cheap excuse for open borders. The amount of capital put into each business has remained constant. The pool of capital available has shrunk.

Another hypothesis a friend and colleague has advanced is that the real explanation is a cultural shift – the shift to professional money managers and financial advisors. These people don’t invest in small business because they don’t understand it, because it’s not securitized and theorized. Now, the theories behind the markets are mostly bunk used by over-groomed finance professors to pleasure themselves, as seen by the regular failure of EMH and MPT. But that may also be a cause. Financial advisors don’t feel comfortable in this pool. You might find that explanation more sound.

No jokes today. Monetarism is the death of American business. It is the death of the American dream. I don’t like the gold standard, but it imposes discipline on central bankers. The Rothschild-backed gold standard never saw madness like this. Coincidentally, it would probably be easier for me to get funding, but your dear Monsieur would never act selfishly, I promise.

You may not be interested in markets, but markets are interested in you.

Sincerely,

Monsieur le Baron

* If your alleged odds of staying in the top quintile starting in the top quintile by conventional mobility models are .35, then the odds of staying in the top quintile for 20 generations (a relatively conservative survival horizon, many families are older, including big ticket names) are 7.6e-10, something that only happens a few times in all of humanity’s existence. Not recorded history. Human existence. The short version is that Raj Chetty is wrong and his optimistic, sunny estimates of social mobility are practically utopian.